Remediation FAQ

- For more general information regarding Tax Documents, see Tax Documentation Guide.

- For additional detail and best practices with respect to reviewing curing documentation, see Curing Documentation.

What is Tax Document Remediation?

When a Tax Document (primarily Form W-8BEN, W-8BEN-E, W-8IMY) is submitted by an end customer, it is the responsibility of the collector to review the information provided on the Tax Document, in tandem with certain other information on file for the end customer, to determine whether the Tax Document is acceptable, and can be relied upon for the purposes in which it is being collected.

Why is remediation necessary?

To the extent a Tax Document provided by an end customer is not acceptable, it is typically best practice to remediate the Tax Document, as soon as possible, before relying upon it for purposes of completing year-end reporting. It is also important to understand any withholding obligations that could arise due to the status of the customer’s tax documentation. You should contact your tax advisor for further information on your obligations to report and withhold.

A Tax Document can be deemed not acceptable for a variety of reasons, but in general, it is because the form has not been completed properly, or the information provided on the form is either inconsistent, or conflicts with other information on file for the end customer.

For example, a Form W-8BEN provided by an individual should not include a post office Box / care-of address, and should instead include a direct, physical address. However, one of the most common reasons a Form W-8 must be remediated is because of the existence of US Indicia.

When is remediation necessary?

Remediation is generally necessary in the following situations:

- The Form W-8 is invalid due to facial errors

- The Form W-8 contains US Indicia

- The Form W-8 contains in-care/of or P.O. Box information

- The Form W-8 has expired

- A Change in Circumstances has been detected for an Account Owner

What is US Indicia?

The term US indicia has the meaning set forth in 1.1471-4(c)(5)(iv)(B) when applied to an individual and as set forth in 1.1471-3(e)(4)(v)(A) when applied to an entity.

With respect to an individual, it includes —

- Designation of the account holder as a US citizen or resident

- A US place of birth

- A current US residence address or US mailing address (including a US post office box)

- A current US telephone number (regardless of whether such number is the only telephone number associated with the account holder)

- Standing instructions to pay amounts from the account to an account maintained in the US

- A current power of attorney or signatory authority granted to a person with a US address

- An “in-care-of” address or a “hold mail” address that is the sole address the FFI has identified for the account holder

When used with respect to an entity, it includes —

- Classification of an account holder as a US resident in the withholding agent's customer files

- A current US residence address or US mailing address

- With respect to an offshore obligation, standing instructions to pay amounts to a US address or an account maintained in the US

- A current telephone number for the entity in the United States, but no telephone number for the entity outside of the United States

- A current telephone number for the entity in the United States in addition to a telephone number for the entity outside of the United States

- A power of attorney or signatory authority granted to a person with a US address

- An “in-care-of” address or “hold mail” address that is the sole address provided for the entity

How do I Remediate Tax Documentation in the TaxBit System?

In general, there are two potential remediation actions that can be taken to resolve documentation issues:

- Submit a New Form W-8, W-9, or Self-Certification

- Obtain Curing Documentation

Submit a New Form W-8, W-9, or Self-Certification

Certain issues noted may be resolved by the resubmission of an updated tax document. For example, the inclusion of a post-office box address as a permanent address on a Form W-8BEN may be resolved by the resubmission of a Form W-8BEN with a direct, physical permanent address.

Once an updated tax document is submitted, the new form should be reviewed to determine whether any previously identified issues on a Tax Document have been resolved.

TaxBit’s Digital W-8/W-9 product will review any newly submitted Tax Document against the previous Tax Document on file to determine whether any open issues have been resolved, as well as whether any new issues exist. The results of that review can be found within the TaxBit Dashboard.

Obtain Curing Documentation

Certain issues noted are otherwise resolved by the collection of curing documentation. This process involves contacting the end customer for additional documentation to substantiate the information provided on the Form W-8 – see additional information below regarding what should be considered prior to “accepting” curing documentation.

TaxBit’s Digital W-8/W-9 product allows you to indicate that acceptable curing documentation has been obtained from the end customer within the TaxBit Dashboard. Once this has been done, the Tax Document on file will be re-reviewed to determine whether any open issues remain, and the status of the Tax Document will update accordingly.

Review of Curing Documentation

For additional detail and best practices with respect to reviewing curing documentation, see Curing Documentation.

When are certain remediation actions required?

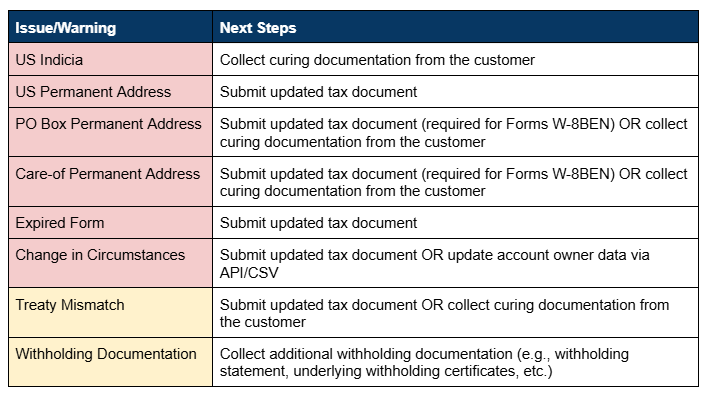

The following chart summarizes the curable and/or non-curable issues on a Form W-8BEN, W-8BEN-E, W-9, and Self-Certification identified by TaxBit’s Tax Documentation Tool, and the related remediation action options.

Issues in the TaxBit System

Issues indicate that the submitted tax document is invalid due to missing, conflicting, or non-compliant information. These issues must be resolved before the form can be considered valid for tax and withholding purposes.

The following issues may appear:

US Indicia

This issue most commonly denotes that a submitted Form W-8 includes one of the following –

- US Permanent Address

- US Mailing Address

However, it can also be the result of information being provided for other purposes, such as –

- US Address

- US Tax Residency

- US Place of Birth

US Permanent Address

This issue denotes that a US Permanent Address was provided on a Form W-8.

Please note that while a Form W-8 may not include a US Permanent Address, an end customer may separately provide a US mailing address. For reference, however, in both of these instances, additional curing documentation may be required – which is tracked and denoted via the US Indicia issue.

PO Box Permanent Address

This issue denotes that a post office box was provided as the Permanent Address on a Form W-8.

For reference, an end customer may separately provide a post office box as a mailing address without any additional follow-up questions.

Care-of Permanent Address

Similar to PO Box Permanent Address above, this issue denotes that a care-of address was provided as the Permanent Address on a Form W-8.

For reference, an end customer may separately provide a care-of address as a mailing address without any additional follow-up questions.

Expired Form

This issue denotes that a Form W-8 that was previously submitted has expired. This document should no longer be relied upon, and a new Form W-8 should be solicited from the end customer.

For reference, the reliability of a Form W-8 expires at the end of the third calendar year following the signature date. For example, a Form W-8 signed on March 1, 2023 would expire on December 31, 2026.

Change in Circumstances

This issue occurs when new information is provided for an Account Owner—such as TIN, name, or tax residency—that differs from what was reported on the most recent Form W-9, W-8, or Self-Certification. This discrepancy invalidates the existing form, and a new submission should be collected.

Warnings in the TaxBit System

Not all flagged items indicate a problem that invalidates a form. Some are categorized as warnings, which highlight potential inconsistencies or areas that may require further review—but do not make the form invalid on their own. These warnings are meant to guide customers in identifying edge cases that may need clarification or additional documentation depending on their internal risk tolerance or compliance procedures.

The following warnings may appear:

Treaty Country Mismatch

This warning denotes that the treaty claim country selected on the Form W-8 does not match the country provided in the permanent or mailing address. This mismatch may require additional documentation or clarification before the form can be considered valid.

This is a warning and does not make the form invalid, but it may require additional documentation or clarification to support the treaty claim.

Withholding Documentation

This warning denotes that the account owner provided information indicating they are an intermediary, which may require additional documentation.

This is a warning and does not make the form invalid. However, further withholding documentation—such as withholding statements or certificates for underlying owners—may be required based on the tax classification selected. In some cases, the account owner may need to submit a different form if the Form W-8IMY was provided in error.

Updated 4 months ago